Federal Insurance Contributions Act (FICA): What It Is, Who Pays

Por um escritor misterioso

Descrição

The Federal Insurance Contributions Act (FICA) is a U.S. payroll tax deducted from workers

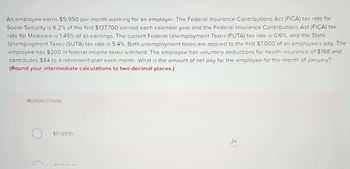

Answered: An employee earns $5,950 per month…

Federal Insurance Contributions Act - Wikipedia

An employee earns $6,200 per month working for an employer. The

FICA Tax: What It is and How to Calculate It

What Is FICA On My Pay Stub? Find Out Now!

What is FICA

:max_bytes(150000):strip_icc()/fica-taxes-social-security-and-medicare-taxes-398257_FINAL-5bbd10af46e0fb00266df9ec-b3794e561e094118ad5b5ed3c6898880.png)

Learn About FICA, Social Security, and Medicare Taxes

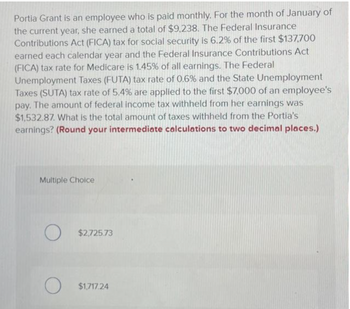

Answered: Portia Grant is an employee who is paid…

FICA Tax: What is FICA Tax, Rates, Exemptions and Calculations

What is the Federal Insurance Contributions Act (FICA

FICA: Definition, 2022 Rates and Limits, Rules for Self-Employed

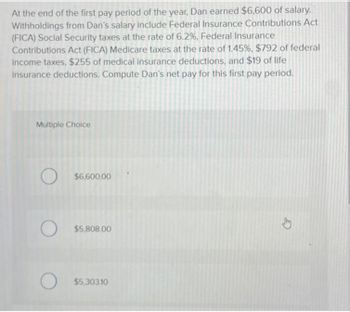

Answered: At the end of the first pay period of…

Definitions and Importance of Determining Non-FICA Wages — Video

de

por adulto (o preço varia de acordo com o tamanho do grupo)