EMV Merchant Liability Shift: Who Covers the Cost of Credit Card

Por um escritor misterioso

Descrição

How EMV credit cards will protect you from financial fraud

Visa Reason Code 10.2: EMV Liability Shift Non-Counterfeit Fraud

The U.S. EMV Chip Card Migration: Considerations for Card Issuers - Community Banking Connections

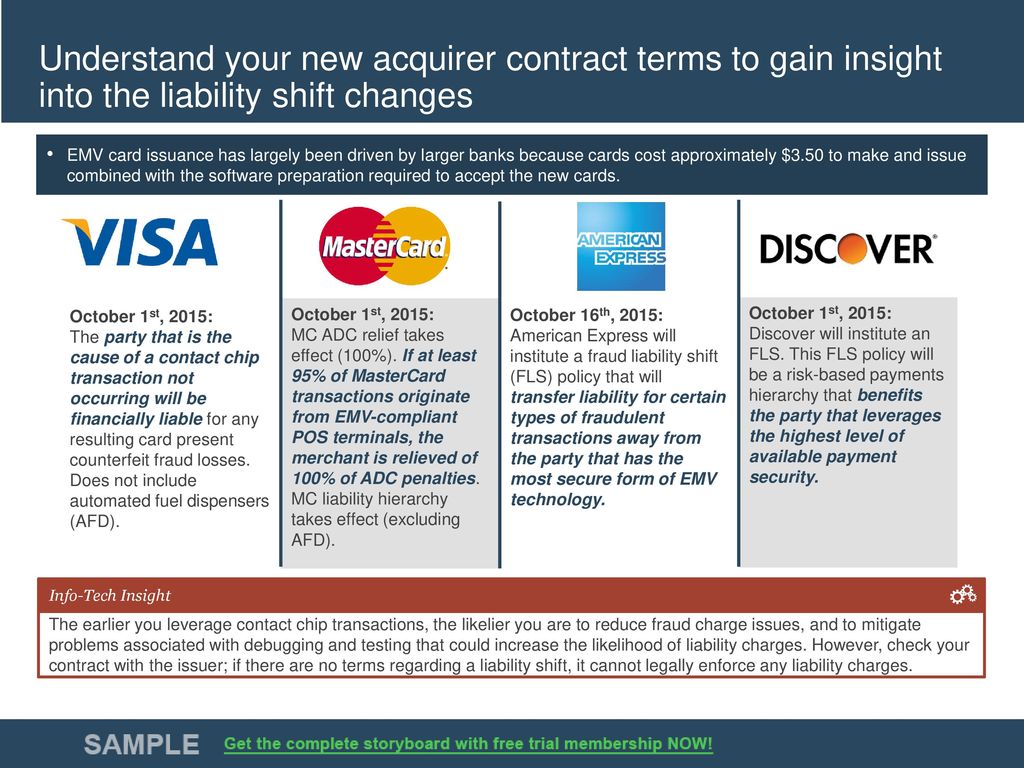

Navigate the EMV Liability Shift - ppt download

EMV Liability Shift and the General Store- The General Store

What You Will Pay For A More Secure Credit Card

EMV Compliance: What Merchants Need to Know

The EMV Liability Shift is Almost Here

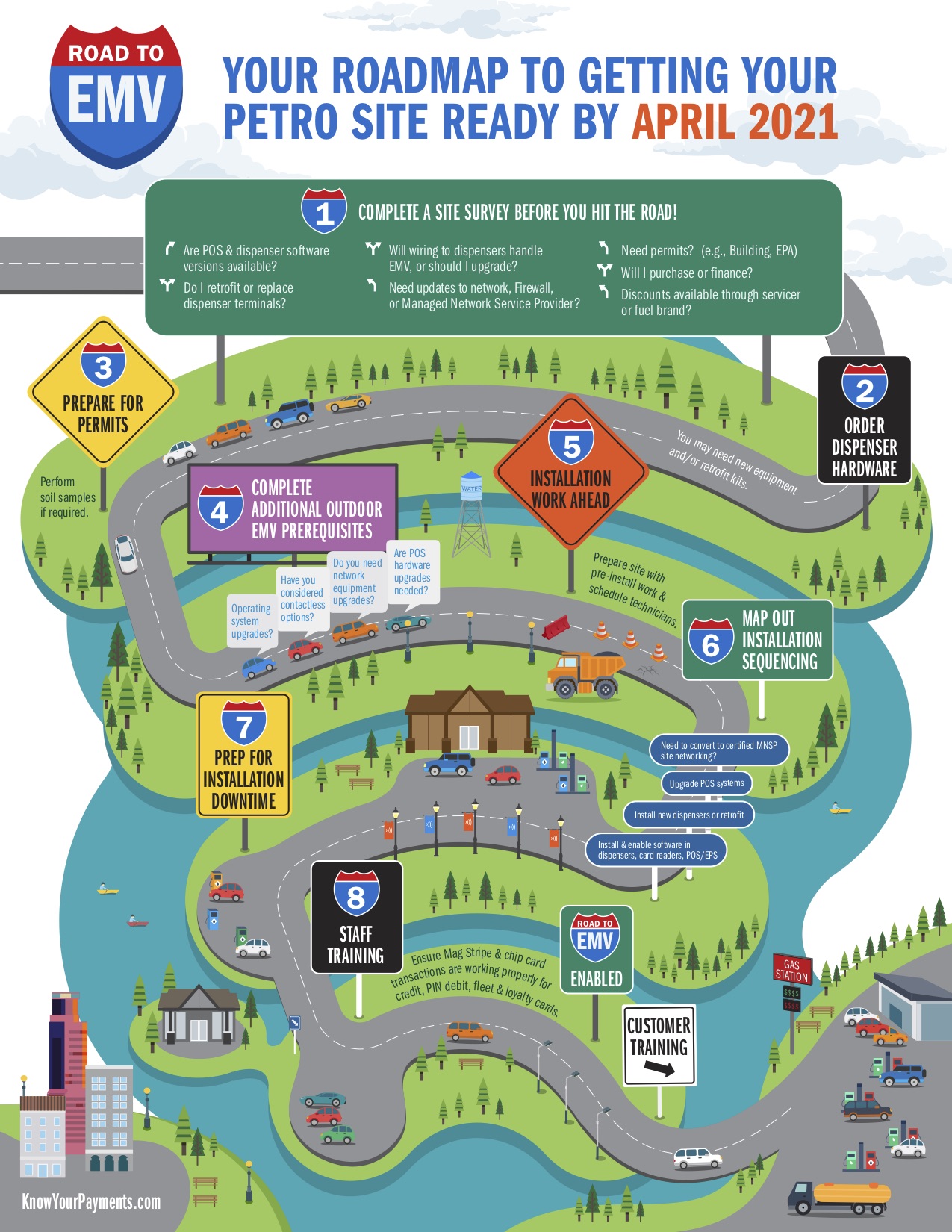

Know Your Payments » EMV Technology

EMV Liability Shift: Merchants Question Benefits Of Shift To Chip-Enabled Credit Card Terminals

Navigate the EMV Liability Shift - ppt download

The Great EMV Fake-Out: No Chip For You! – Krebs on Security

Mastercard Reason Code 4870 Chip Liability Shift

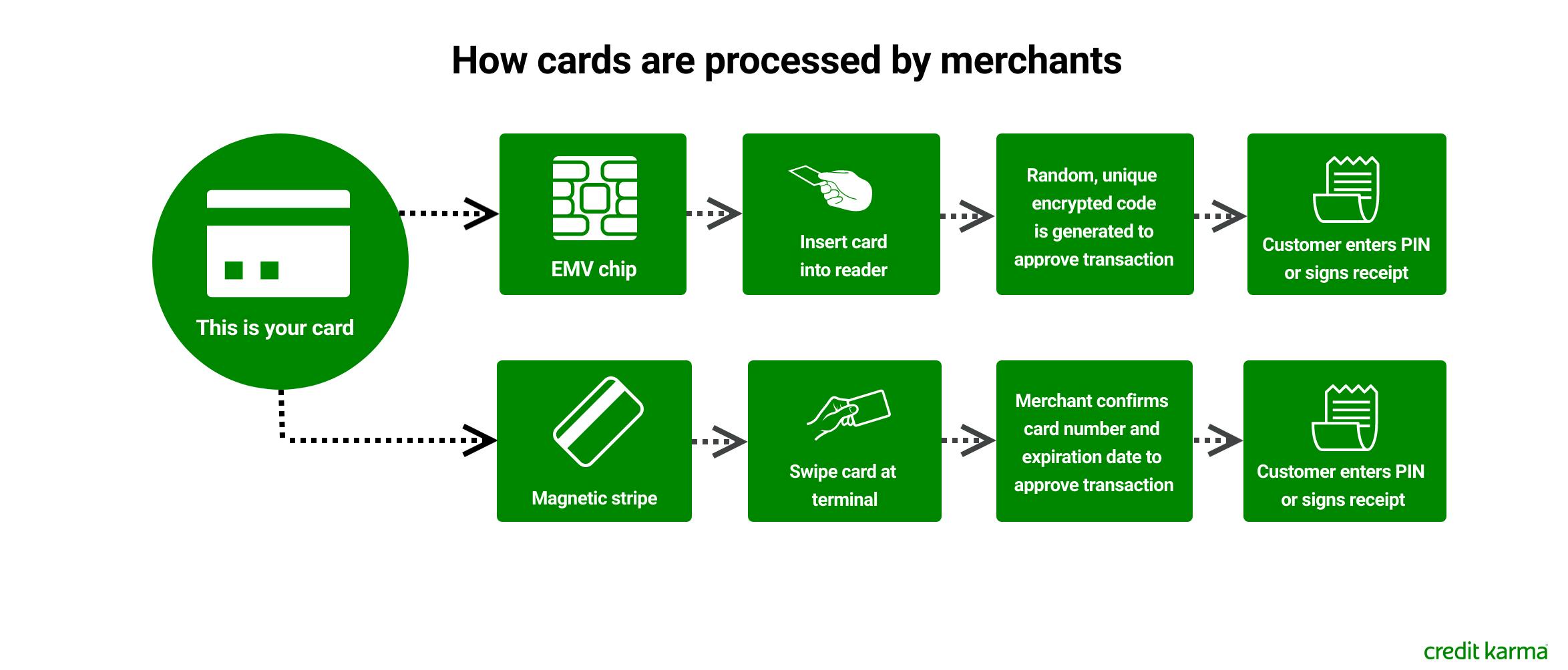

How the EMV Credit Card Chip Works

Customer Liability for Chipped Card (EMV) Fraud

de

por adulto (o preço varia de acordo com o tamanho do grupo)