Theory of Liquidity Preference Definition: History, Example, and

Por um escritor misterioso

Descrição

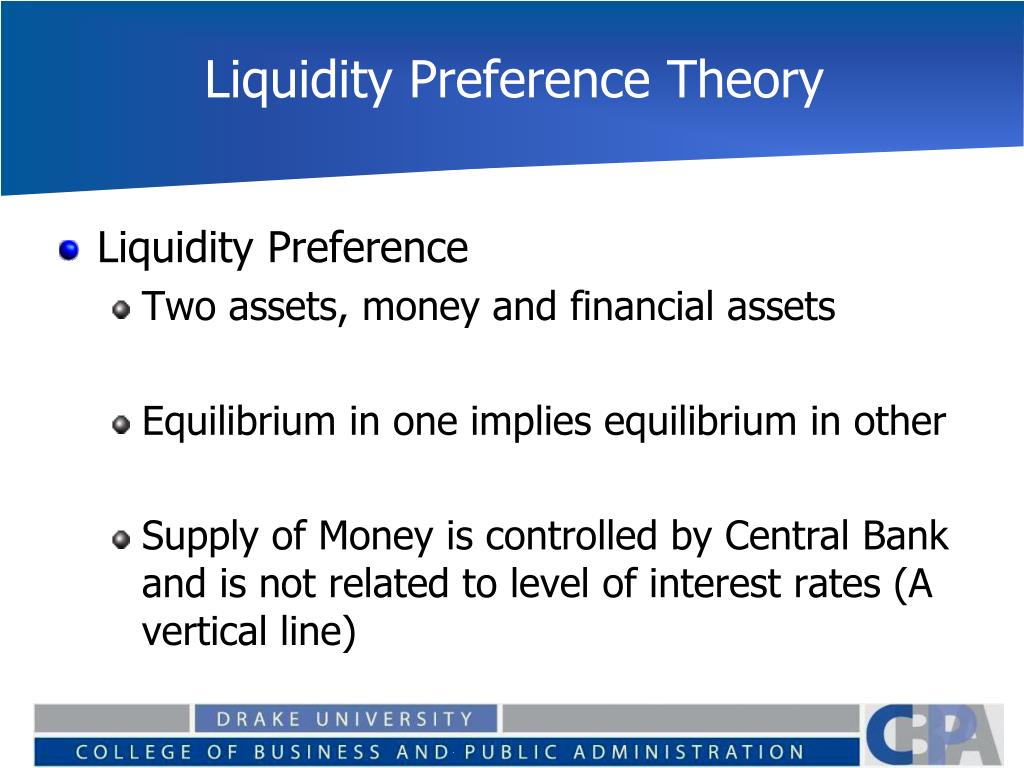

Liquidity preference theory concerns how stakeholders value cash relative to receiving interest over varying lengths of time.

Perry Mehrling, Which citadel? – Just Money

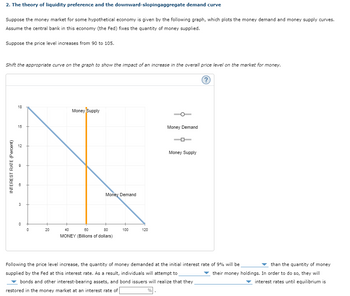

Answered: 2. The theory of liquidity preference…

Liquidity Preference Theory of Keynes - Interest Rate, Example

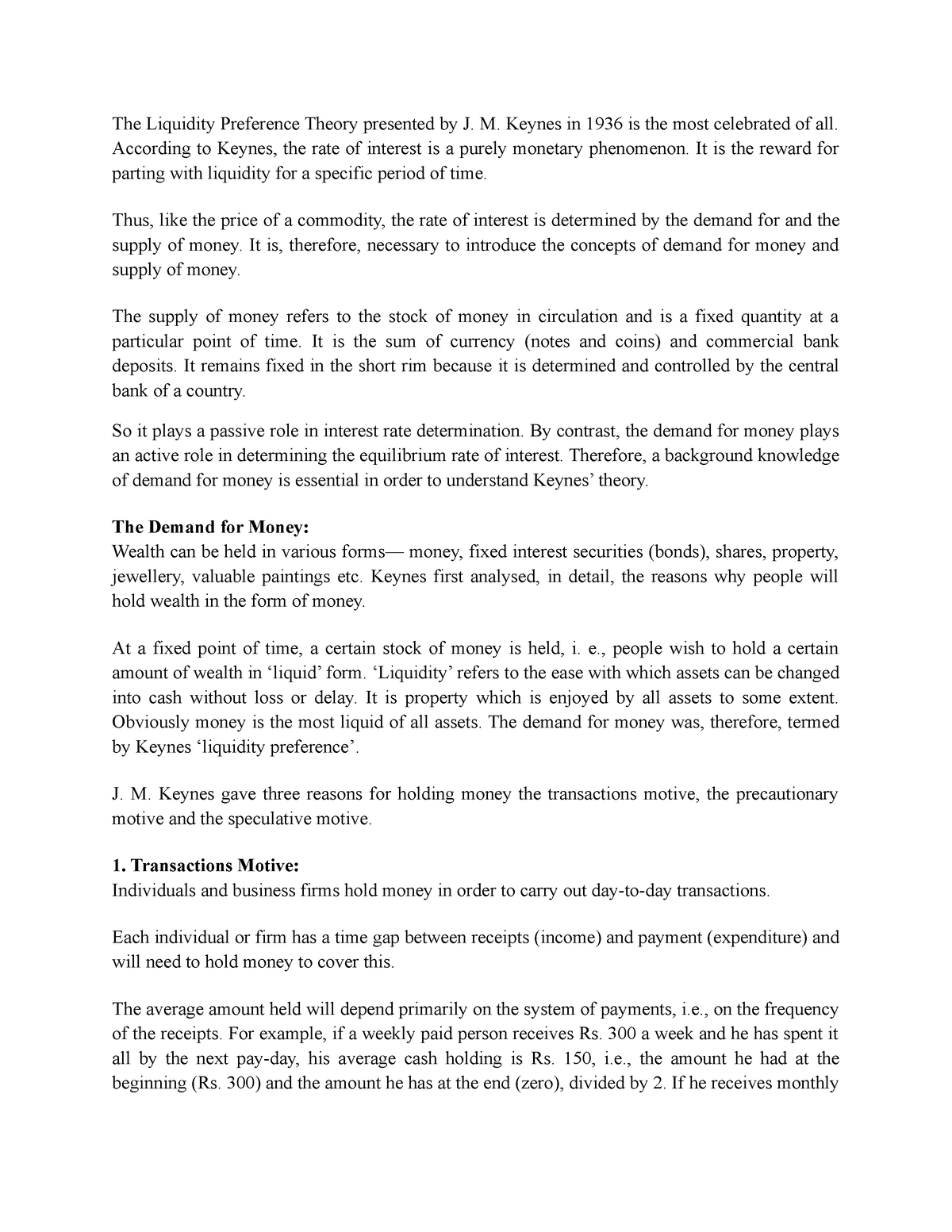

The Liquidity Preference Theory presented by J - M. Keynes in 1936 is the most celebrated of all. - Studocu

According to the liquidity preference theory of money, explain what happens when the interest rate is above the level that equates money demand with money supply. Provide a specific example to illustrate

Keynes on Monetary Policy, Finance and Uncertainty: Liquidity Preferen

PPT - Interest Rate Risk PowerPoint Presentation, free download - ID:4268950

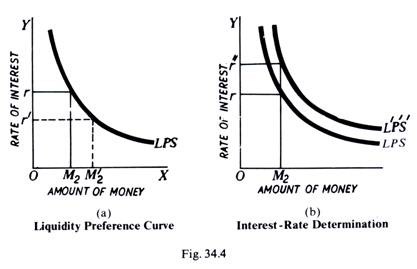

Liquidity Preference Theory: Motives and Criticism (With Diagram)

Liquidity Preference Theory Role explained in detail // Unstop (formerly Dare2Compete)

Liquidity Preference Theory:Definition, Example, & Key Insights

PDF) Liquidity Preference Theory of Interest (Rate Determination) of JM Keynes

:max_bytes(150000):strip_icc()/clock-1129436381-d43365a9ab2a4644830227ed7acfffab.jpg)

Theory of Liquidity Preference Definition: History, Example, and How It Works

Liquidity trap - Wikipedia

àThe liquidity preference theory was an attempt to displace the prevailing theory of interest (and financial asset pricing)--the loanable funds theory. - ppt download

Ch19

de

por adulto (o preço varia de acordo com o tamanho do grupo)

:max_bytes(150000):strip_icc()/Contempt-court_final-428cf76a922241579e284031e50979d4.png)

:max_bytes(150000):strip_icc()/socialnetworking-13cadb0b8b5941ab999a13c06e468821.jpg)

:max_bytes(150000):strip_icc()/Subordinated_Debt_Final-9aa6c6855b944c68bbc92fafaf12bd9b.png)