What Is Social Security Tax? Definition, Exemptions, and Example

Por um escritor misterioso

Descrição

The Social Security tax, levied on both employers and employees, funds Social Security and is collected in the form of a payroll tax or a self-employment tax.

Clergy Taxes: Understanding Social Security: Medicare with IRS Pub 517 - FasterCapital

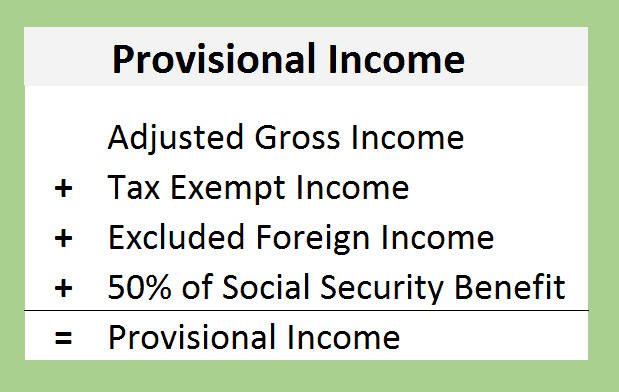

Research: Income Taxes on Social Security Benefits

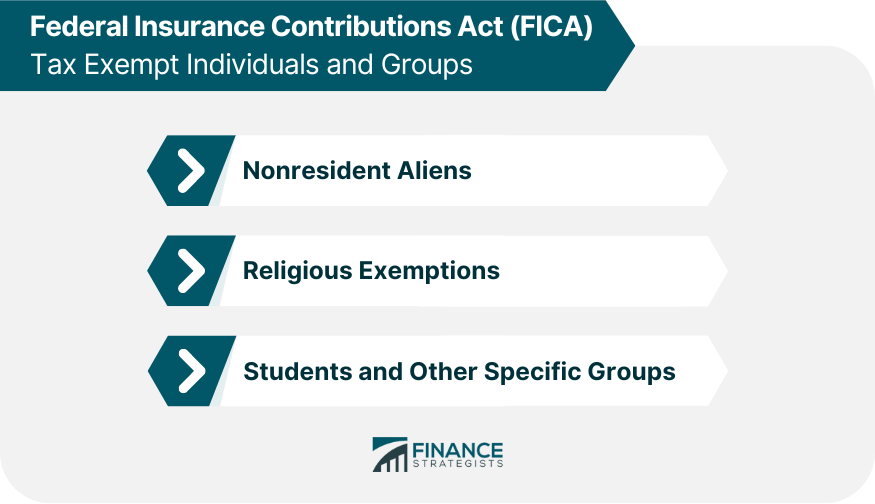

What Is FICA Tax? A Complete Guide for Small Businesses

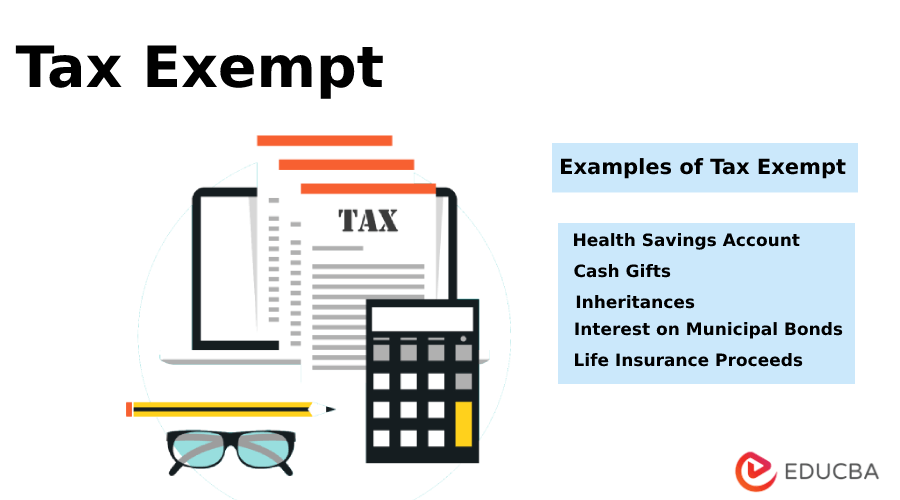

10 Ways to Be Tax Exempt

Not Always Tax-Free: 7 Municipal Bond Tax Traps

Tax Exempt, Importance of Tax Exempt

Tax on Social Security Benefits – Social Security Intelligence

Social Security COLA Increase for 2023: What You Need to Know - The New York Times

Research: Income Taxes on Social Security Benefits

de

por adulto (o preço varia de acordo com o tamanho do grupo)