FICA Tax Rate: What Are Employer Responsibilities? - NerdWallet

Por um escritor misterioso

Descrição

Employers and employees must pay FICA taxes to contribute to social security and medicare. What you need to know.

Federal Insurance Contributions Act - Wikipedia

LLC vs. Sole Proprietorship: How to Choose - NerdWallet

FICA Tax Rate: What Are Employer Responsibilities? - NerdWallet

FICA Tax: Rates, How It Works in 2023-2024 - NerdWallet

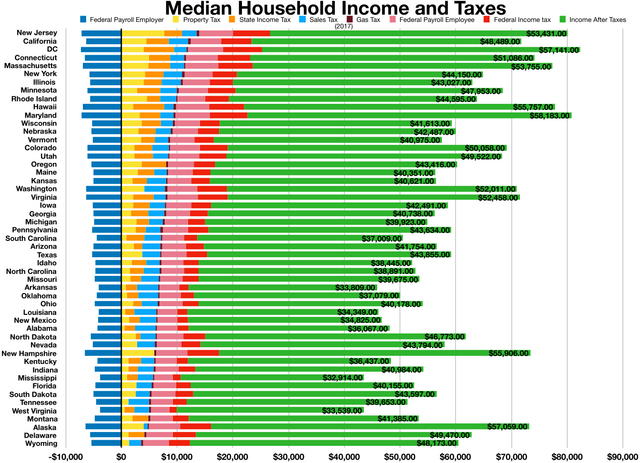

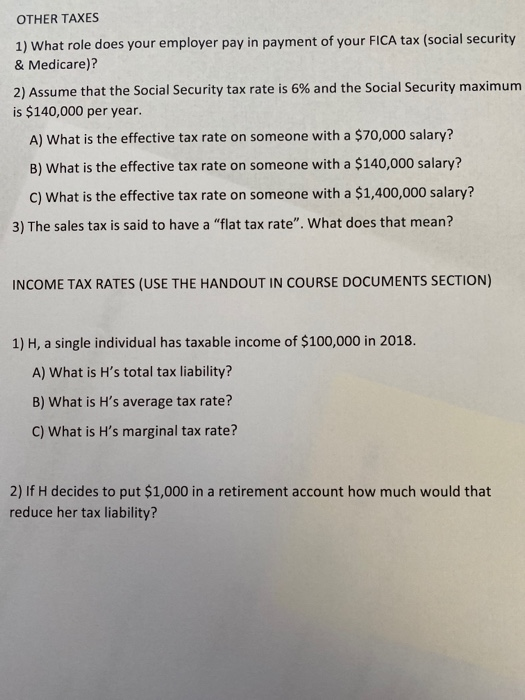

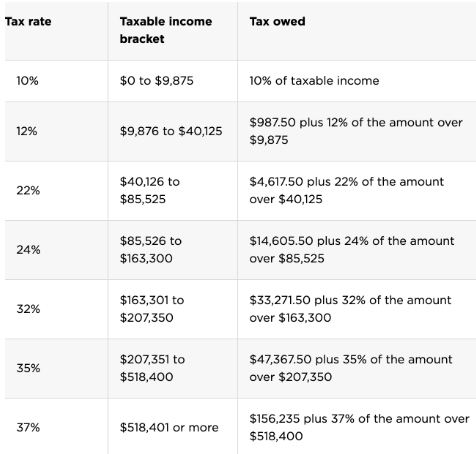

OTHER TAXES 1) What role does your employer pay in

Federal Insurance Contributions Act: FICA - FasterCapital

Hiring a Remote Worker? It Takes More Than an Internet Connection - NerdWallet

Minimum Car Insurance Requirements by State - NerdWallet

How LLCs Pay Taxes - NerdWallet

The Difference Between Marginal Tax Rates and Effective Tax Rates — and When to Use Them. - Thompson Wealth Management

FICA Tax Rate: What Are Employer Responsibilities? - NerdWallet

de

por adulto (o preço varia de acordo com o tamanho do grupo)