What is FICA Tax? - The TurboTax Blog

Por um escritor misterioso

Descrição

Quick Answer: FICA is a payroll tax on earned income that covers a 6.2% Social Security tax and a 1.45% Medicare tax. If you’ve watched “Friends,” you can probably relate to Rachel opening her first paycheck and asking, “Who’s FICA? Why’s he getting all my money?” If you asked, you were probably told it was

Do Social Security Income Recipients Pay Income Taxes? TurboTax

How Much are Medicare Deductions for the Self-Employed? - The

Taxes Archives - Page 2 of 3 - The TurboTax Blog

FICA Tax Guide (2023): Payroll Tax Rates & Definition - SmartAsset

Why Software is Winning the Tax Prep Wars - The TurboTax Blog

New! TurboTax Tax Reform Calculator Educates on How Tax Reform

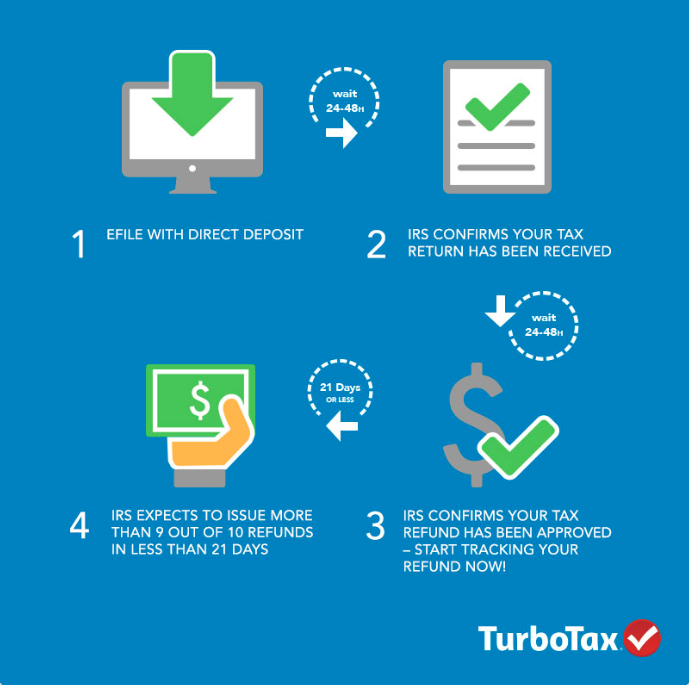

Where's My Tax Refund? - The TurboTax Blog

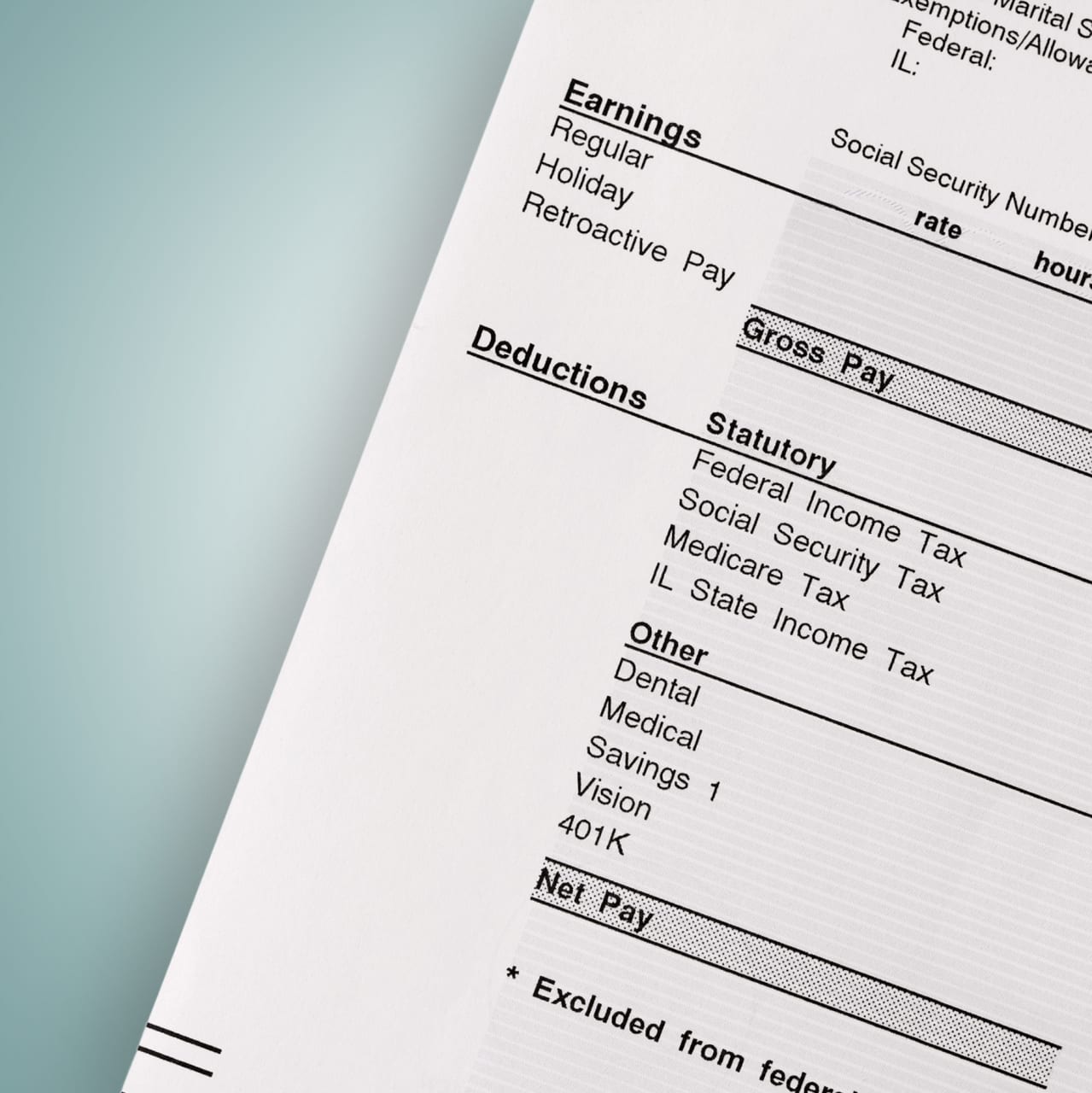

How to Read Your Pay Stub - Buy Side from WSJ

What are self-employment taxes? - TurboTax Support Video

FICA Tax Exemption for Nonresident Aliens Explained

FICA Tax Exemption for Nonresident Aliens Explained

de

por adulto (o preço varia de acordo com o tamanho do grupo)