The advisory has directed taxpayers to check bank validation for

Por um escritor misterioso

Descrição

Jun 22, 2023 - The advisory has directed taxpayers to check bank validation for their GSTINs on the portal. The GSTN released the advisory on 24th April 2023, advising taxpayers to cross-check the bank account validation in GST. The taxpayer must take suitable action or wait, depending on the bank account validation status. Following are the types of bank account validation status- Success Failure Success with remark Pending for verification

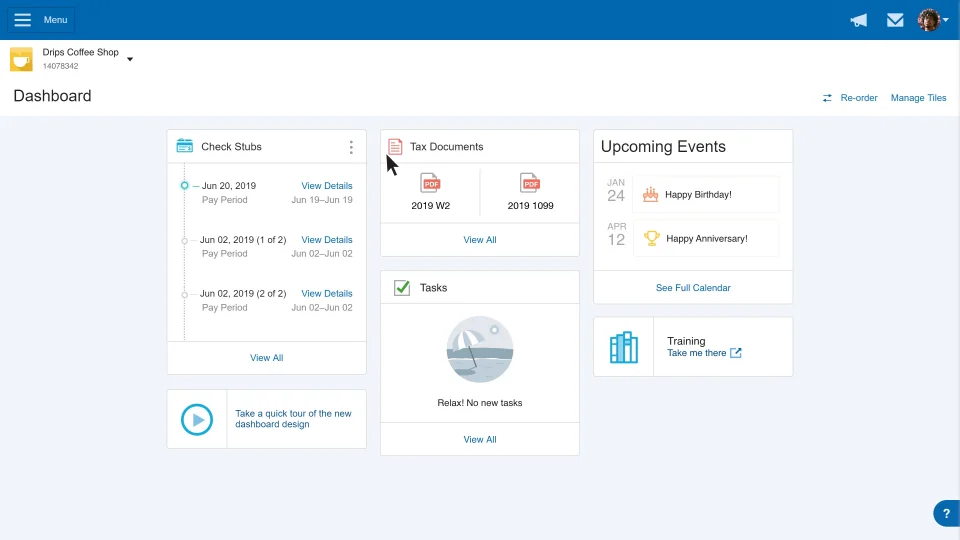

W-2 Frequently Asked Questions

Supreme Court Says the IRS Can Secretly Obtain Your Bank Records - CPA Practice Advisor

:max_bytes(150000):strip_icc()/1099-A-0151e1f82f624920b802b26d693d47f6.jpg)

Form 1099-A: Acquisition or Abandonment of Secured Property

IRS Aims to Tax the Gig Economy, and Misses - Bloomberg

)

Waiting For Your Income Tax Refund? CBDT Advises Taxpayers To Check Bank Account Validation Status - Learn How To Do It, Personal Finance News

Medicare Advantage plans overcharged Medicare by millions : Shots - Health News : NPR

How Can An Aadhaar Card Help You? – Forbes Advisor INDIA

Recognizing Employee Retention Credit Scams

Tax Filing Support International Student and Scholar Services

What Is a Donor-Advised Fund? Five DAF Facts That Advisors Need to Know to Help Their Clients Manage Their Giving

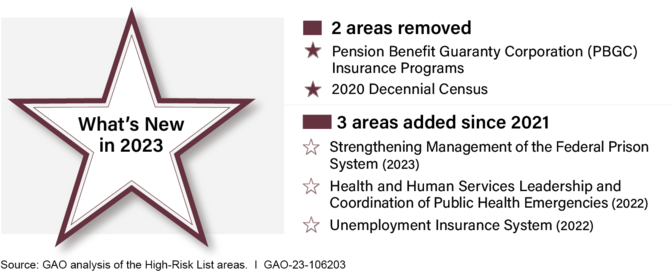

HIGH-RISK SERIES Efforts Made to Achieve Progress Need to Be Maintained and Expanded to Fully Address All Areas

de

por adulto (o preço varia de acordo com o tamanho do grupo)

:max_bytes(150000):strip_icc()/final_crossholding_definition_1019-95008f5a687541289653ca88ef52be14.jpg)